Updated: December 5, 2022

Donor Advised Funds (or DAFs) are an increasingly popular way to make charitable donations to 501(c)(3) organizations. The reasons for their popularity include:

- Being able to donate to the DAF today and recommend which charity (or charities) receive the funds in the future

- Receiving a charitable tax deduction in the year that you give to the DAF, not in the year that you distribute the funds to the charity (note: in order to utilize the deduction, you must itemize your deductions rather than take the standard deduction)

- Investing undistributed funds while they remain in the DAF

- Last, by not least, there can be significant tax advantages when you donate appreciated stock rather than cash to your DAF

Regarding the last point, let’s look at an example. We’ll assume you bought a share of stock for $50 and you held it until it reached $100 today.

Also, we’ll assume the highest marginal tax rates apply:

- Federal ordinary income of 37%

- California state income state of 12.3% (applicable to both ordinary and capital gains)

- Federal long-term capital gains of 20%

Federal investment income tax (ACA tax) on sale of stock of 3.8%

When you donate to charity (or a DAF) you receive a tax deduction in the amount of the donation. You receive the same tax deduction whether you donate $100 of cash or a $100 of stock. However, when you donate appreciated stock, you never pay the tax on the capital gain, which is why donating appreciated stock is usually better than donating cash.

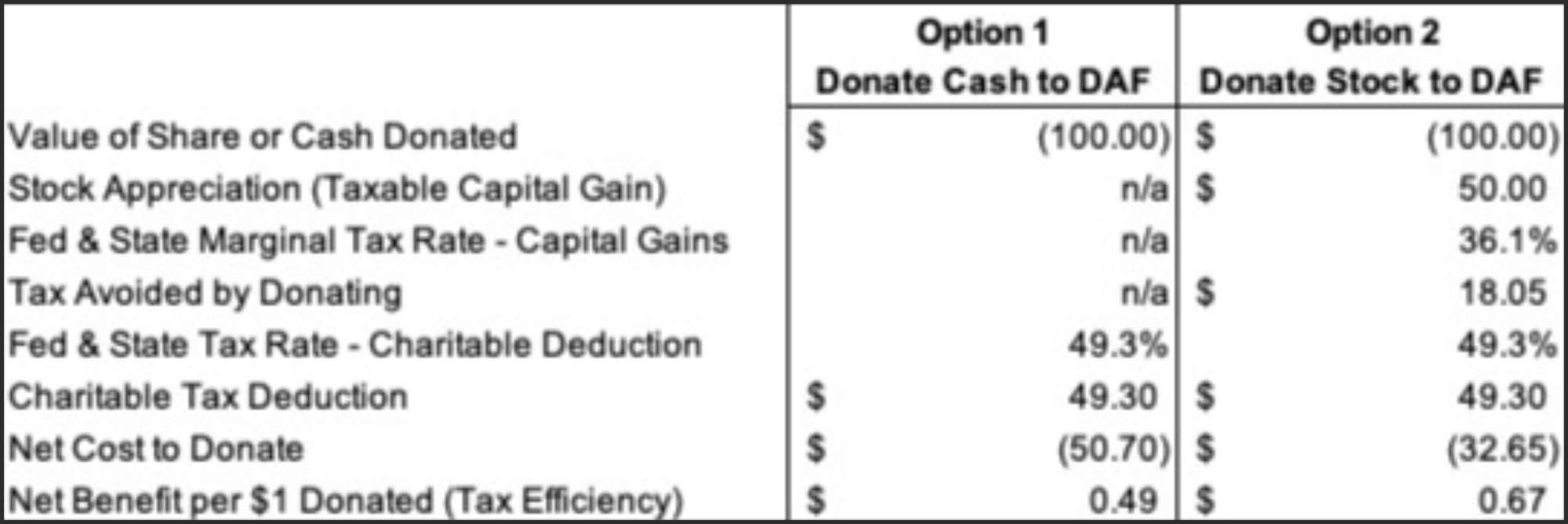

Let’s compare the two options using the assumptions.

As shown in the table below, donating $100 cash (Option 1) will actually cost you $50.70 since you save $49.30 in taxes from the charitable tax deduction. But what if you donate $100 of the appreciated stock (Option 2)? You still receive the same charitable tax deduction, but you also avoid the tax on the capital gain of $18.05. When you add those two benefits, the cost of donating the stock goes down to $32.65. The difference is the result of avoiding the capital gains tax!

Now, what if you assume you donate stock that has appreciated less and lower marginal tax brackets? These assumptions would reduce the tax benefit of donating the appreciated stock. But the larger point still remains: donating appreciated stock is usually more tax efficient than donating cash because you’re avoiding the tax on the gain (assuming you don’t exceed the limitations on stock donations).

You can read more about DAFs here. Let us know if you’d like to further discuss all the benefits of opening a DAF and/or gifting strategies to maximize the tax benefits.

Disclosures: