Updated: June 1, 2022

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

– Warren Buffett

In the investing world, there are a million and one ways to define risk. Ok, not really. But there are a lot. Get a group of investors in a room, ask them each to define risk and you’ll likely get a handful of different responses. The most common definition is volatility. Stocks, for example, are considered risky because they are volatile. But if you’re a long-term investor, does volatility really matter that much? Aren’t there more relevant ways to think about risk?

Yes, yes there are.

If you’re a long-term investor, another (and, we would argue, better) way to define risk is the probability of having a permanent loss of capital. This happens when, for example, you sell something for less than you bought it. If you buy something and it temporarily declines while you still hold it, you have volatility but you have not had a permanent loss of capital.

Think about this in the context of a portfolio of stocks.

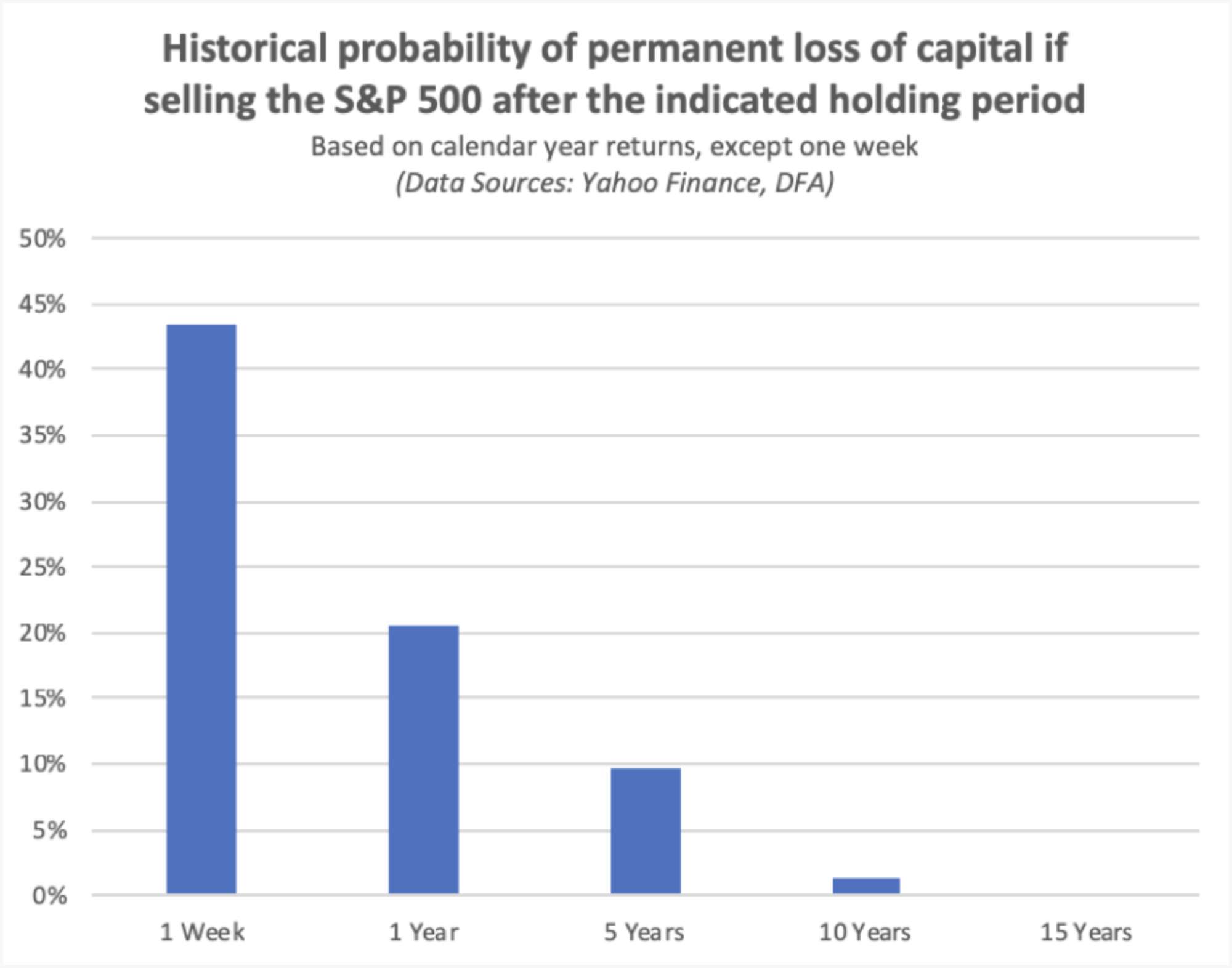

Let’s say you have a ten-year investment horizon and hold a diversified basket of stocks through an S&P 500 index fund. If you have absolutely no need or plan to sell anything from this portfolio over the next ten years, then, using the definition of risk laid out above (i.e., that risk is defined as a permanent loss of capital), this portfolio has low risk. Why? Because, over a ten year period, the probability of having a permanent loss of capital is low. Going back to 1950, there has been only one ten-year period (looking at calendar year returns) in which you would have lost money by selling after 10 years (2000 – 2009, towards the high of the dot-com bubble and low of the 2008-2009 financial crisis). In other words, historically speaking, there was about a 1.4% probability of losing money over a ten-year period. Now, there are a bunch of caveats to this, including that the future could easily be different than the past, that I’ve ignored intra-year holding periods and that inflation will take away part of your return. Still, you can see the odds are strongly in your favor if you have a ten-year holding period. What about other holding periods? Check out the chart below.

As you can see, once you extend out to about 10-15 years, the historical likelihood of having a permanent loss of capital has been quite low.

So, if you’re a long-term investor, don’t fret about the daily, weekly and annual ups and downs of the market. Ignore the silly talking heads who tell you where the market is going this year (hint: they have no clue). None of this matters to you. What matters is where markets are ten to fifteen years from now. And based on history, although there are certainly no guarantees, the odds are highly in your favor.

John Bogle, the founder of Vanguard, was definitely on to something when he said, “The stock market is a giant distraction to the business of investing.”

Disclosures: